Chan and I have known each other for over 15 years. We met during our reservist days with MINDEF.

We got to talking and stayed in touch over shared experiences in the aviation industry. Over time, I came to learn that Chan is one of the most patient persons that I have ever met. There wasn't a single angry bone in his body, which made him great to be working as a customer service executive in the aviation industry.

A Mistake Into Debt

However, it was during this time that he choked up substantial credit card debts of over S$25,000.

It was in such a dire state that he had sought help from credit counseling and had consolidated all credit card arrears across 5 banks. With a fixed payment to the banks, Chan was often left with very little cash on hand.

Because of a single slip-up in his financials, Chan and his wife had it tough for over a decade.

However, one of the better things that had happened to him was that he got an HDB BTO 4-room flat in Sengkang in 2013. This helped his living arrangements and slightly eased the burden of his financials. I found out that in spite of his own troubles, Chan had gotten the HDB to help support the accommodation for his mother-in-law, sister-in-law, and brother-in-law.

A Hard Hit From Covid-19

As we all know, when COVID-19 hit, the aviation industry collapsed. Chan, being a customer service executive in the aviation industry was not spared either. While he was lucky to retain his job, he had a 30% pay cut.

Unable to sustain his family through his debt and the plague, Chan had shared with me his troubles and approached me for a solution. Taking into account his entire financial portfolio and his liabilities, I shared with him and his wife that the only way to sustain their family was to sell their HDB flat.

Out of Darkness

I'm a firm believer that there will always be light in the darkness, and true enough - during the pandemic, because of the delays of all BTO projects, first-time buyers turned to purchasing resale HDB, pushing the demand rocket high.

This was unheard of in the industry, but having it swing into a seller's market was just the thing Chan needed.

Into the Light

I urged Chan to speak to his in-laws and decide quickly on the sale.

Chan, his wife, and I sat down to do an in-depth real estate plan — from selling to buying. We realized that with sufficient CPF from the couple, they were able to afford a humble resale condo after selling their flat. The market was in overdrive - we did 13 viewings, of which 3 offers came through and we closed the sale in less than 2 weeks.

What Would You Do With $150,000?

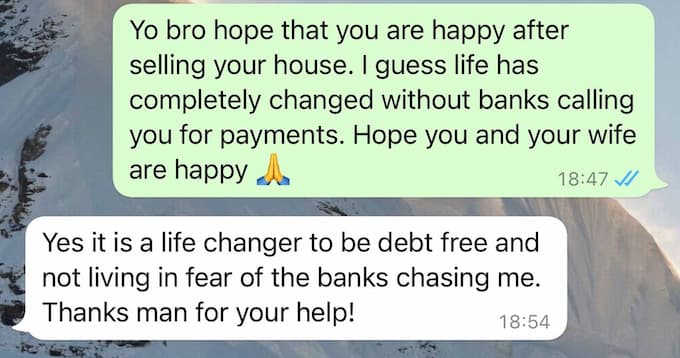

On 21 April 2022, Chan received one of the highest amounts of cheques he had ever seen in his life. The next day, at 2 pm, Chan immediately paid off all the banks in full and lifted the decade-long financial burden from him.

Impact Of Doing Good

I was so touched and delighted that the impact created through providing the correct real estate advice could be so big. I admit to shedding a tear when I think of those many tough years Chan had gone through.

Satisfaction That Money Cannot Buy

My experience with Chan has spurred me to help many others. Beyond helping others through life's tough journey, I have also pledged 3% of my real estate income to the National Cancer Society as a tribute to my late mom whom we lost to cancer.

With empathy and love, we change the world in little ways! I strongly urge everyone to find something meaningful to do in their lives.

I think I found mine!