If you are looking to obtain an HDB flat in Singapore, you have come to the right place. Resale HDB in Singapore has come to be a popular occurrence as of late. Hence, it is essential for you to know the steps to buying a resale HDB so that the process remains smooth for you, should you decide to buy a resale HDB in Singapore.

In this article, we will explain in detail the steps to buying a resale HDB in Singapore. Read up until the end to gain the full spectrum of knowledge on the topic at hand before you practically take an action in this direction.

12 Easy Steps for Buying a Resale HDB

Here are 12 easy steps to purchase a resale HDB in Singapore.

Register

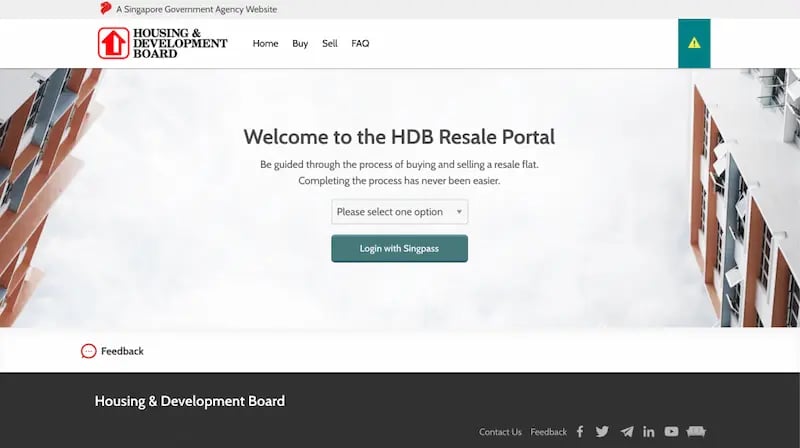

You must register an intent to buy first and foremost. And in order to do so, you must check if you are eligible to do so. The eligibility criteria can be checked from the HDB resale portal itself.

Decide on Other Details

Once you have officially decided to buy resale HDB, you need to decide which kind of flat you want to buy in resale HDB. The Ethnic Integration Policy and the Singapore Permit Resident Quota needs to be taken into account while taking this step. Once you have figured out these details you may check your personal affordability spectrum when choosing which kind of flat you are interested in.

Look Into the Documents Sent to You

Soon after you have registered for an intent to buy, you will be sent a few documents from the HDB resale portal. These will include your eligibility for CPF housing grants and eligibility for an HDB housing loan. Make sure to adjust your decision in accordance with these documents.

Figure Out Financing Details

Once you have your affordability in check, along with all the eligibility criteria, you may go about the different financing channel options you may want to use to buy the resale HDB in Singapore. Shortlist and finalize your options at this stage. This decision will be financed while taking into account the down payment options, the interest rates at that point in time, and also whether or not there is a lock-in period for the kind of loan you plan to take.

Adjust for Other Costs

When buying an HDB resale flat, you will have to pay some other minimalistic fees as well. These will include the administrative fee for the resale application ($40-80), a valuation fee ($120), insurance, and some legal fee as well.

Make the Offer

When making the offer, a non-refundable option needs to be paid. This may range anywhere between $1 and $1000. However, you must keep in mind that most of the time, sellers do decide to charge the highest amount of $1000. When this detail is decided, the buyer must send you the OTP that they must receive from the HDB resale portal. Receiving this OTP means that the seller has agreed to not sell the chosen flat to anyone else but you.

Discuss Extension of Stay Details

Sometimes, after making the sale, the seller will let you know that they cannot vacate the premises immediately. In such a case you will need to discuss the details of their stay extension. This extension also needs to be officially submitted via the resale portal set up by HDB. The minimum period of allowed occupation starts when the extension of stay from the side of the seller ends.

Check for Valuation

If you have chosen a loan option other than HDB’s own loan, like the CPF loan, you will have to check for the valuation of the flat so that an appropriate loan can be granted to you. This valuation check will be done by HDB once you submit an official request to them to do so. However, you may not simply request a valuation check, you will have to provide some specific credentials to HDB at this stage as well. These credentials are listed below:

-

First page of the OTP document as a softcopy

-

Address of the flat you are buying

-

Serial number of your OTP

-

Seller’s details

-

Your details

-

Contact details of the person making the valuation check request

Accept the OTP (Option to Purchase)

You must ensure that you do so before the OTP expires. This may be done by signing the acceptance form and making sure the signed document reaches the seller on time. An exercise fee also needs to be paid at this stage. Together with the above-mentioned option fee, it will form the deposit. The deposit cannot total to be more than $5000. Hence, if your option fee was, let’s say, $1000, then your exercise fee cannot be more than $4000.

Complete and Submit the Application

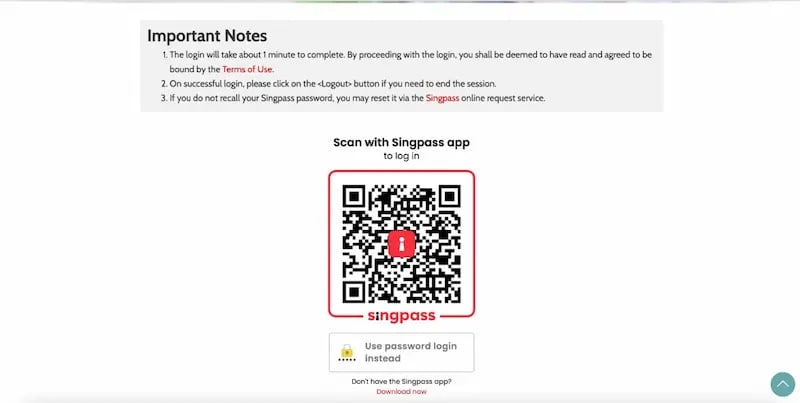

A major part of the final stages of completing the application is to read and accept the terms and conditions. When you receive a notification via SMS within 10 days of accepting the OTP, you may go and read these terms and conditions.

You have to ensure that you do so diligently and do not take this stage lightly as most people do when it comes to the terms and conditions of any deal or transaction. The terms and conditions may be accepted on the official HDB resale portal. Now, you must receive in-principle approval for resale.

Make the Payment and Receive Approval

You will know that the approval of your application is uploaded on the HDB resale portal once you receive a notification, once again, via SMS. You will also get the details of the Completion Appointment which will be within 8-10 weeks of the official approval of the application.

Attend the Resale Completion Appointment

During this appointment, the signing of the transfer document will take place, along with the mortgage document (if applicable). You will be handed the keys to your new flat and the process will be complete!

Concluding Remarks

If you have made it to this point in the article, then it means you are ready to buy a resale HDB in Singapore. So wait no longer and start the process of obtaining an HDB flat for yourself by following the steps to buying a resale HDB as explained in this post above.